Top 20 best loan apps in kenya

Finding reliable loan apps in Kenya can be challenging with many available options. E.g Branch, Tala, Timiza, KCB M-pesa, etc.Mobile lending platforms have transformed how Kenyans access cash for personal and business needs. Here, we dive into 20 trusted loan apps in Kenya, highlighting their features, requirements, interest rates, and more.

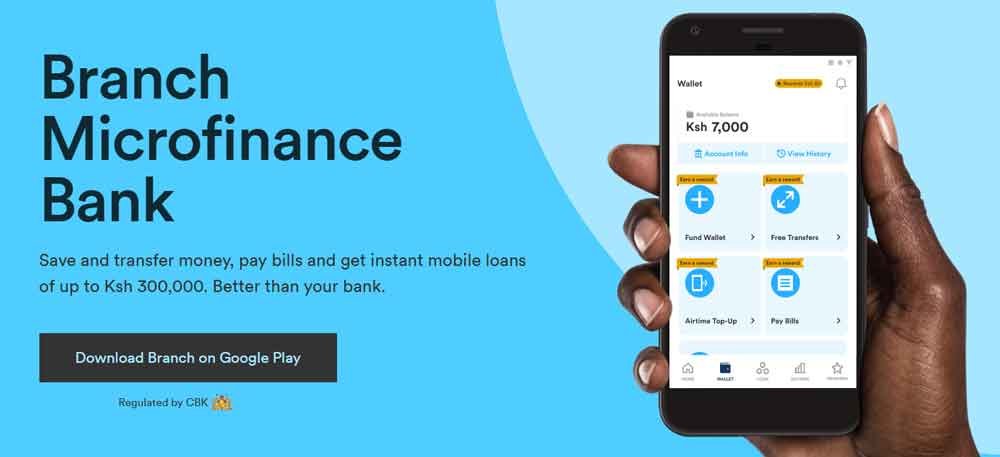

Branch

Branch offers quick, convenient, and low-interest loans to users across Kenya. This app provides various loan limits based on the user’s creditworthiness, allowing Kenyans to access emergency loans, manage financial needs, or finance small projects directly through their mobile devices. With a competitive interest rate and options to extend your loan, Branch is among the best choices for people in Kenya who need reliable access to cash. Download the app, apply for a loan, and receive your loan straight to your M-Pesa.

- Interest Rates: • Interest Range: 17% – 35%

- Requirements/Eligibility: You need a phone number or Facebook account, National ID, and mobile money account to apply.

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 300 – Ksh 300,000

- Loan Duration: 1 – 12 Weeks

- Late Payment Fees: None, but late payments affect credit score

- Regulated by CBK

- How to Access:

- Available on Android only

- Apply via the Branch app on Google Play

Zenka Loan App Kenya

Zenka Loan App Kenya, developed by Zenka Digital Limited, is known for fast, flexible loans with a unique first-time offer of a zero-interest loan. Ideal for emergency loans, Zenka is perfect for those who need cash quickly without high interest fees. With flexible loan tenure and options like the ZenkaFlexi option, users can extend their loans to meet their needs. Download the Zenka finance app to access loans up to Ksh, apply for a loan, and have funds sent directly to your M-Pesa account, helping you manage financial challenges effortlessly.

- Interest Rates: 11% to 29% based on loan term

- Requirements/Eligibility: Must be a Kenyan resident with an active M-Pesa account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 50,000

- Loan Duration: 1 month or 61-day loan payment terms have an interest fee of 9-39%*

- Late Payment Fees: 1.5% of the loan amount per day

- How to Access:

- Available on Android

- Apply via Zenka app on Google Play

Zenka can be reached via Phone: +254 (0) 207650878 or E-mail: support@zenka.co.ke

Timiza loan apps in kenya

Timiza, offered by Absa Bank, is ideal for those needing quick cash with a straightforward loan process linked to their mobile money accounts. Duly licensed and trusted across Kenya, Timiza offers loans up to Ksh for Kenyans needing emergency loans or short-term financial support. With a competitive interest rate and privacy and security features, Timiza is designed to meet the needs of people in Kenya looking for reliable financial assistance.

- Interest Rates: 1.17% monthly

- Requirements/Eligibility: Must have an active Safaricom line

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 50 – Ksh 150,000

- Loan Duration: 30 days

- Late Payment Fees: Ksh 5 daily

- How to Access:

- USSD: Dial *848#

- Available on Android

- Apply via Timiza app on Google Play

KCB M-Pesa loan app

KCB M-Pesa, a collaborative product between KCB Bank and Safaricom, offers flexible loan options to M-Pesa users seeking convenient financing. Users can apply for a loan directly through their phones, receiving loans up to Ksh based on their needs and credit history. With competitive interest rates and a reliable data controller, KCB M-Pesa ensures privacy and security, making it among the best choices for people in Kenya who need quick access to funds. The app is a trusted source for emergency loans, helping individuals manage financial needs efficiently.

- Interest Rates: 7.35% monthly

- Requirements/Eligibility: Must be a registered M-Pesa user

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 1,000 – Ksh 1,000,000

- Loan Duration: 30 days

- Late Payment Fees: 2.5% monthly

- How to Access:

- USSD: Dial *844#

- Available via M-Pesa menu on the Safaricom app

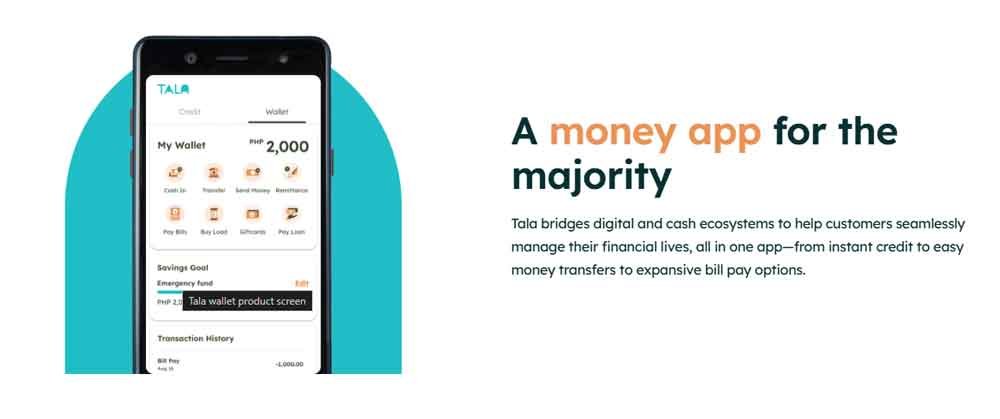

Tala

Tala is a popular loan app that has built trust in Kenya by offering quick, unsecured loans to users with flexible repayment terms. Tala offers various loan amounts based on user creditworthiness, allowing you to apply for a loan that meets your needs. Trusted by millions, Tala has helped people in Kenya with emergency loans and is recommended for its seamless loan process and privacy standards. Download the Tala loan app, and enjoy loans up to Ksh directly to your M-Pesa with flexible loan tenure and repayment options.

- Interest Rates: 11% to 15%

- Requirements/Eligibility: Must have an active M-Pesa account and be a Kenyan citizen

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 500 – Ksh 50,000

- Loan Duration: 21 to 30 days

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android

- Apply via Tala app on Google Play

Chapaa Loan – Easy for Cash

Chapaa Loan provides easy access to small cash loans with no collateral requirements, making it ideal for emergency situations. Users can apply for a loan and receive their first loan directly to their M-Pesa account within minutes. With privacy and security as a priority, Chapaa Loan is trusted by many in Kenya for its straightforward application process, making it among the best for quick financial support.

- Interest Rates: 12% monthly

- Requirements/Eligibility: Active mobile number and valid ID

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 250 – Ksh 50,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 10% of loan amount

- How to Access:

- Available on Android

- Apply via Chapaa Loan app on Google Play

Helasasa – Line of Credit Loan

Helasasa offers a line of credit with quick approval and competitive rates, allowing users to manage short-term financial needs efficiently. It’s ideal for people looking to apply for a loan with a competitive interest rate. With flexible loan tenure, Helasasa offers loans up to Ksh and transfers funds straight to your M-Pesa account, making it an accessible option for those in Kenya needing reliable financial assistance.

- Interest Rates: 10% monthly

- Requirements/Eligibility: Kenyan resident, over 18, with M-Pesa

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 1,000 – Ksh 30,000

- Loan Duration: 15 to 45 days

- Late Payment Fees: 3% of loan amount

- How to Access:

- Available on Android

- Apply via Helasasa app on Google Play

OKash loan apps in kenya

OKash offers quick and reliable loan services to Kenyans with an easy approval process. Users can apply for a loan and receive funds directly to their M-Pesa for short-term financial support. With competitive interest rates, privacy and security measures, OKash is recommended for users seeking trustworthy and efficient financial solutions for emergencies or day-to-day needs.

- Interest Rates: 14% monthly

- Requirements/Eligibility: Kenyan resident with a valid ID and active M-Pesa account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 50,000

- Loan Duration: 15 to 30 days

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android

- Apply via OKash app on Google Play

iPesa loan apps in kenya

iPesa provides instant mobile loans with flexible terms, ideal for emergency cash needs. Users can apply for a loan with iPesa, selecting from options that offer flexible repayment schedules. This app provides a quick and secure way to receive your loan directly to M-Pesa, ensuring privacy and security for those needing immediate financial support.

- Interest Rates: 12% monthly

- Requirements/Eligibility: Kenyan resident, M-Pesa account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 50,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 2% of loan amount

- How to Access:

- Available on Android

- Apply via iPesa app on Google Play

Kashway

Kashway is known for its fast processing and easy application process, catering to users looking for small, short-term loans.

- Interest Rates: 10% monthly

- Requirements/Eligibility: Must have a valid ID and active M-Pesa

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 200 – Ksh 50,000

- Loan Duration: 15 to 30 days

- Late Payment Fees: 2% of loan amount

- How to Access:

- Available on Android

- Apply via Kashway app on Google Play

Equity Mobile

Equity Mobile, offered by Equity Bank, is a popular choice among small business people in Kenya. Equity Bank provides loans with competitive interest rates, perfect for those needing quick cash with flexible repayment terms. You can apply for a loan through the app and have it sent straight to your M-Pesa, with options to extend your loan and manage your finances more effectively.

- Interest Rates: 1.08% monthly

- Requirements/Eligibility: Must have an Equity Bank account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 1,000 – Ksh 3,000,000

- Loan Duration: 1 to 12 months

- Late Payment Fees: Variable based on loan terms

- How to Access:

- USSD: Dial *247#

- Available via Equity Bank app on Android and iOS

LendPlus

LendPlus offers fast, easy loans with flexible repayment options, especially suited for users needing smaller loans. This app is designed for people in Kenya looking for emergency loans with competitive interest rates. With LendPlus, you can apply for a loan and receive your funds directly to your M-Pesa, ensuring a smooth and secure lending process.

- Interest Rates: 13% monthly

- Requirements/Eligibility: Valid ID, active mobile number

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 30,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 3% of loan amount

- How to Access:

- Available on Android

- Apply via LendPlus app on Google Play

Opesa

Opesa provides an easy-to-use interface with quick disbursement options, ideal for users who need short-term loans. With Opesa, you can apply for a loan directly through your phone and receive your funds straight to your M-Pesa. Opesa prioritizes privacy and security, making it a trusted app for those seeking emergency cash.

- Interest Rates: 15% monthly

- Requirements/Eligibility: Kenyan resident with active M-Pesa

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 30,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 3% of loan amount

- How to Access:

- Available on Android

- Apply via Opesa app on Google Play

HF Whizz

HF Whizz, by HF Group, is an innovative loan app offering convenient loans to users with a simple application process. HF Whizz provides competitive interest rates and various loan options, catering to people in Kenya who need quick cash without a lengthy approval process. Apply for a loan and get your funds directly to your M-Pesa.

- Interest Rates: 9% monthly

- Requirements/Eligibility: Must have a Kenyan mobile number and valid ID

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 1,000 – Ksh 50,000

- Loan Duration: 1 to 12 months

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android and iOS

- Apply via HF Whizz app on Google Play

M-Shwari

M-Shwari, a product of Safaricom and NCBA, offers financial services, including savings and instant loans, making it popular among M-Pesa users. With M-Shwari, you can apply for a loan, manage your savings, and receive funds directly to M-Pesa. Privacy and security are guaranteed, making M-Shwari a trusted option for financial needs.

- Interest Rates: 7.5% monthly

- Requirements/Eligibility: Must be a registered M-Pesa user

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 100 – Ksh 50,000

- Loan Duration: 30 days

- Late Payment Fees: 7.5% monthly

- How to Access:

- M-Pesa menu on Safaricom app

Check some tips on how to increase your loan limit fast.

Stawika

Stawika provides fast loans with minimal requirements, aimed at helping users with emergency cash needs. You can apply for a loan quickly and receive funds straight to your M-Pesa, ideal for handling urgent expenses. Stawika’s competitive interest rates and user-friendly interface make it a reliable option for people in Kenya.

- Interest Rates: 13% monthly

- Requirements/Eligibility: Valid ID, M-Pesa account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 50,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android

- Apply via Stawika app on Google Play

Zash Loan

Zash Loan offers an easy loan application process, ideal for users seeking short-term loans with flexible repayment options. With Zash, you can apply for a loan, receive funds directly to your M-Pesa, and manage your repayment schedule with ease. This app emphasizes privacy and security, ensuring your data remains secure.

- Interest Rates: 10% monthly

- Requirements/Eligibility: Must have an active M-Pesa account and a valid ID

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 30,000

- Loan Duration: 14 to 30 days

- Late Payment Fees: 2% of loan amount

- How to Access:

- Available on Android

- Apply via Zash Loan app on Google Play

Saida

Saida provides a variety of loan options with flexible repayment schedules, offering financial support for emergencies or small business needs.Apply for a loan with Saida to receive funds straight to your M-Pesa, benefiting from competitive interest rates and secure transactions. Saida is trusted for quick and reliable service among people in Kenya.

- Interest Rates: 12% monthly

- Requirements/Eligibility: Valid ID, active M-Pesa account

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 30,000

- Loan Duration: 1 to 2 months

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android

- Apply via Saida app on Google Play

LionCash

LionCash provides quick cash loans for urgent needs, with flexible terms and an easy-to-use app interface. Download the LionCash app, apply for a loan, and receive funds directly to your M-Pesa account. It’s ideal for those needing emergency loans with privacy and security assured.

- Interest Rates: 14% monthly

- Requirements/Eligibility: Kenyan resident, active M-Pesa

- CRB Status Check: No CRB status check needed

- Loan Amounts: Ksh 500 – Ksh 20,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 3% of loan amount

- How to Access:

- Available on Android

- Apply via LionCash app on Google Play

Mokash

Mokash offers quick loans to Kenyans seeking small, short-term financial support. Apply for a loan with Mokash and receive funds directly to M-Pesa, ideal for handling urgent cash needs. Mokash prioritizes privacy and security, making it a reliable choice for financial support.

- Interest Rates: 10% monthly

- Requirements/Eligibility: Valid ID, active mobile number

- CRB Status Check: CRB status must be in good standing

- Loan Amounts: Ksh 500 – Ksh 30,000

- Loan Duration: 7 to 30 days

- Late Payment Fees: 5% of loan amount

- How to Access:

- Available on Android

- Apply via Mokash app on Google Play

Frequently Asked Questions (FAQs)

1. What is the best loan app in Kenya?

The “best” loan app depends on individual needs, such as loan amount, interest rate, repayment terms, and speed of approval. Popular choices include Tala, Branch, and KCB M-Pesa for their reliability and quick disbursement.

2. Are loan apps in Kenya safe?

Yes, most loan apps in Kenya are safe if licensed by the Central Bank of Kenya and follow strict privacy policies. It’s advisable to check user reviews, app permissions, and the privacy policy to ensure security.

3. Do I need a good CRB status to qualify for a loan?

Some loan apps, like Timiza and Tala, require a CRB status check in good standing, while others, like Branch and Zenka, do not. Each app’s CRB requirement varies, so it’s essential to check before applying.

4. How quickly can I get my loan?

Loan disbursement times vary by app, but many mobile loan apps in Kenya, such as Zenka and Branch, offer instant loan approvals and disburse funds within minutes.

5. What are the typical interest rates for loan apps in Kenya?

Interest rates range from around 1.08% to 15% monthly, depending on the app and loan amount. Always review the interest rate and loan terms before borrowing.

6. What happens if I miss my loan repayment date?

Most loan apps charge a late payment fee or increase the interest rate on overdue loans. Additionally, late payments can impact your credit score with the CRB, affecting future loan eligibility.

7. Can I apply for multiple loans on different apps simultaneously?

Yes, you can apply for loans from multiple apps, provided you meet each app’s eligibility criteria. However, this may increase your debt burden, so it’s crucial to plan your repayments responsibly.

8. Is my personal information secure on these loan apps?

Reputable loan apps follow strict privacy policies to protect user data. However, always read the privacy policy and avoid apps with excessive permissions or negative reviews regarding data security.

9. Can I get a loan if I don’t have an M-Pesa account?

Most loan apps in Kenya disburse loans through M-Pesa, so having an M-Pesa account is typically necessary. Some apps linked to banks, like Equity Mobile, may offer other options.

10. How do I increase my loan limit?

Regular and timely repayments improve your credit score, which can lead to an increased loan limit. Some apps, like Branch and Tala, also reward loyal customers with higher limits over time.