Top 11 Best Money Market Fund in Kenya 2024

Money market funds have become an increasingly popular option for investors looking to grow their wealth in a stable and low-risk environment. But, how do you determine the best money market fund in Kenya for your financial goals? In this article, we will explore everything you need to know about money market funds in Kenya—including average daily yields, key features, minimum investment amounts, and more—to help you make an informed decision.

What is a Money Market Fund (MMF)?

A Money Market Fund (MMF) is a type of mutual fund that invests in low-risk and short-term debt instruments such as Treasury bills, commercial papers, and bank deposits. MMFs aim to provide liquidity, capital preservation, and moderate returns. They are designed for investors looking for a safe place to park their money while earning a higher return compared to a typical savings account.

Money market funds are regulated by the Capital Markets Authority (CMA) in Kenya, ensuring that your investments are managed professionally and according to industry standards. They are an excellent option for both individuals and businesses seeking high-yield investment options without taking on significant risks.

What to Check for Before Choosing a Money Market Fund in Kenya

Before settling on the best money market fund in Kenya, there are some critical factors to consider:

1. Average Yield and Returns

- Check the money market fund returns and their consistency over time. Compare different funds to determine which one offers the highest Kenya money market rates.

2. Management Fees

- Look into the money market fund management fees. These fees may seem small, but they impact your returns in the long run. Opt for funds that have low management costs.

3. Minimum Investment Amount

- Consider the money market fund minimum investment requirement. Choose a fund that aligns with your financial situation.

4. Liquidity

- Understand the money market fund withdrawal terms. Most funds offer high liquidity, but it is important to know how quickly you can access your money.

5. Additional Features

- Assess additional features like ways of depositing money, including whether the fund supports M-Pesa deposits or other online methods.

Key Takeaways

Below, we provide an overview of the top-performing money market funds in Kenya, helping you make the best decision based on features, yields, and requirements.

1. CIC Money Market Fund

The CIC Money Market Fund is one of Kenya’s leading funds, offering an average yield of 13.50% per annum. It is ideal for individuals seeking secure short-term investment options with high liquidity and minimal risk.

| Feature | Details |

|---|---|

| Average Daily Yield | 13.50% per annum |

| Minimum Investment | KSh 5,000 |

| Top-Up Amount | KSh 1,000 |

Features:

- High liquidity, ensuring easy access to your funds when needed.

- Competitive average yield suitable for short-term savings and investments.

- Managed by experienced professionals, focusing on capital preservation.

- No entry or exit fees, maximizing your returns.

Ways to Deposit

- Deposits can be made via M-Pesa using paybill number 888999, bank transfer, debit or credit card through the mobile app, or direct cash deposits at authorized branches. These options ensure convenience and flexibility for all investors.

How to Join

- You can join the CIC Money Market Fund by registering through their mobile app, using their USSD code, or by visiting the nearest CIC branch.

2. Etica Money Market Fund

The Etica Money Market Fund offers a competitive average yield of 15.68% per annum, making it an attractive option for both new and experienced investors. With a low minimum investment of KSh 100 and no lock-in period, it provides easy access and flexibility for all.

| Feature | Details |

|---|---|

| Average Daily Yield | 15.68% per annum |

| Minimum Investment | KSh 100 |

| Top-Up Amount | KSh 100 |

Features:

- No lock-in period; full flexibility for your withdrawals.

- Daily compounding of interest, credited to clients’ accounts.

- High liquidity, ensuring you can access your money quickly.

- Professional management of investments, focusing on capital preservation.

Ways to Deposit

- You can deposit money via M-Pesa using paybill number 123456.

How to Join

- You can join by signing up through their mobile app or visiting their website for online registration.

3. Lofty-Corban KSH Money Market Fund

Lofty-Corban KSH Money Market Fund provides an average yield of 15.26% per annum and focuses on capital preservation, making it suitable for low-risk investors. With a minimum investment of KSh 1,000, it offers high liquidity and easy access to your funds.

| Feature | Details |

| Average Daily Yield | 15.26% per annum |

| Minimum Investment | KSh 1,000 |

Features:

- High liquidity, allowing easy access to your funds.

- Investments in bank deposits, Treasury bills, and commercial papers.

- Focuses on capital preservation, suitable for low-risk investors.

- No initial fees for joining the fund.

Ways to Deposit

- Deposits can be made via M-Pesa paybill number 234567 or via bank transfer.

How to Join

- You can join by using their USSD code, signing up through their mobile app, or visiting their office.

4. Apollo Money Market Fund

Apollo Money Market Fund offers an average yield of 15.05% per annum, with a minimum investment of KSh 1,000. It is a great choice for investors looking to invest in low-risk instruments such as T-bills and government bonds while benefiting from daily compounding.

| Feature | Details |

| Average Daily Yield | 15.05% per annum |

| Minimum Investment | KSh 1,000 |

| Top-Up Amount | KSh 1,000 |

Features:

- Investment in low-risk instruments like fixed deposits, T-bills, and government bonds.

- Daily compounding of interest to maximize returns.

- High liquidity, allowing easy withdrawals.

- Low minimum investment, suitable for small investors.

Ways to Deposit

- You can deposit money via M-Pesa using paybill number 345678 or through bank transfer.

How to Join

- Registration can be done online through their website or by visiting the nearest branch.

5. Nabo Money Market Fund

The Nabo Money Market Fund provides an average yield of 14.89% per annum and requires a higher minimum investment of KSh 100,000. It is ideal for investors looking for higher yields and flexibility, with no withdrawal limitations and monthly compounded interest.

| Feature | Details |

| Average Daily Yield | 14.89% per annum |

| Minimum Investment | KSh 100,000 |

| Top-Up Amount | KSh 10,000 |

Features:

- Daily interest compounded monthly, ensuring maximum growth.

- Investments in short-term debt securities.

- High liquidity, ensuring quick access to your funds.

- No withdrawal limitations, allowing full flexibility.

Ways to Deposit

- Deposits can be made via bank transfer or visiting the branch.

How to Join

- You can join by signing up through their online portal or visiting their offices.

6. GenAfrica Money Market Fund

GenAfrica Money Market Fund offers an average yield of 14.80% per annum with no specified minimum investment. It features high liquidity and no initial fees, making it an attractive option for both individuals and businesses seeking flexible investment opportunities.

| Feature | Details |

| Average Daily Yield | 14.80% per annum |

| Minimum Investment | Not specified |

Features:

- No initial fees for opening an account.

- Easy top-up via online portal or bank transfer.

- High liquidity, allowing for easy access to funds.

- No withdrawal restrictions, making it an excellent option for all types of investors.

Ways to Deposit

- Deposits can be made via bank transfer or online top-up.

How to Join

- Join through their online registration portal.

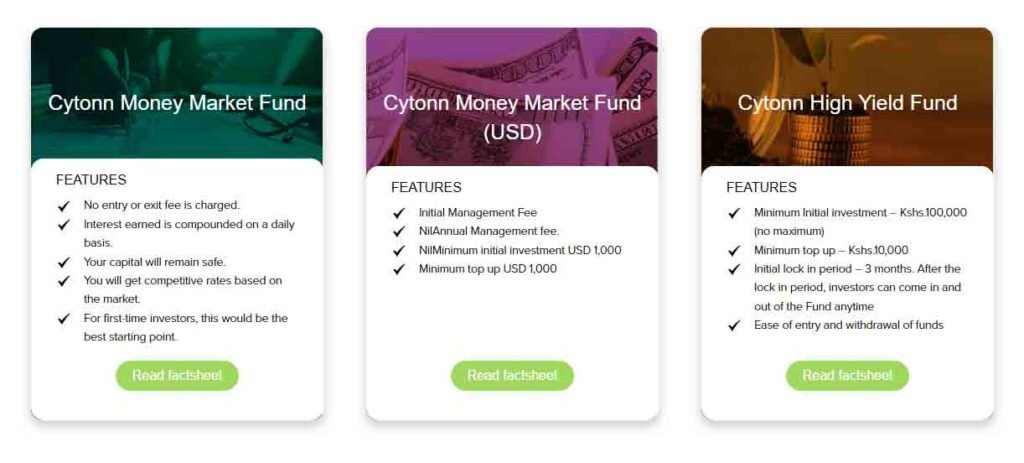

7. Cytonn Money Market Fund

Cytonn Money Market Fund has an average yield of 14.49% per annum and a low minimum investment of KSh 1,000. It offers an easy sign-up process via USSD and no entry or exit fees, making it an appealing choice for small investors.

| Feature | Details |

| Average Daily Yield | 14.49% per annum |

| Minimum Investment | KSh 1,000 |

| Top-Up Amount | KSh 100 |

Features:

- No entry or exit fees, maximizing returns.

- Interest is earned daily and compounded monthly.

- Easy sign-up via USSD code.

- Focus on short-term investment options.

Ways to Deposit

- You can deposit using M-Pesa with paybill number 456789.

How to Join

- Join through their USSD code or website.

8. Enwealth Money Market Fund

Enwealth Money Market Fund offers an average yield of 13.91% per annum, with a low minimum investment of KSh 1,000. It is designed for individuals looking for capital preservation and stable returns, with easy access and no withdrawal restrictions.

| Feature | Details |

| Average Daily Yield | 13.91% per annum |

| Minimum Investment | KSh 1,000 |

| Top-Up Amount | KSh 1,000 |

Features:

- Investments in high-quality short-term instruments.

- Focuses on capital preservation and stable returns.

- Easy access to funds with no withdrawal restrictions.

- Low initial investment suitable for individuals looking for low-risk investment funds.

Ways to Deposit

- Deposits can be made via bank transfer or M-Pesa paybill number 567890.

How to Join

- Registration can be done through their website or by visiting their offices.

9. Kuza Money Market Fund

The Kuza Money Market Fund provides an average yield of 13.74% per annum, with a minimum investment of KSh 5,000. It features high liquidity, secure short-term investments, and easy online management, making it a convenient option for many.

| Feature | Details |

| Average Daily Yield | 13.74% per annum |

| Minimum Investment | KSh 5,000 |

| Top-Up Amount | KSh 1,000 |

Features:

- High liquidity, allowing easy withdrawals.

- Investments in secure short-term debt instruments.

- Daily interest compounding for maximum returns.

- Supports online account management.

Ways to Deposit

- Deposits can be made via bank transfer or online portal.

How to Join

- Join by signing up online or visiting the branch.

10. Madison Money Market Fund

Madison Money Market Fund offers an average yield of 13.58% per annum with a minimum investment of KSh 5,000. It focuses on capital preservation, making it an ideal choice for risk-averse investors who want easy access to their funds.

| Feature | Details |

| Average Daily Yield | 13.58% per annum |

| Minimum Investment | KSh 5,000 |

| Top-Up Amount | KSh 1,000 |

Features:

- Focus on capital preservation, making it ideal for risk-averse investors.

- Investments in short-term securities.

- High liquidity, allowing easy access to funds.

- Low minimum investment requirement.

Ways to Deposit

- Deposits can be made via M-Pesa paybill number 678901 or bank transfer.

How to Join

- Registration can be done through the mobile app or by visiting their office.

11. Co-op Money Market Fund

The Co-op Money Market Fund provides an average yield of 13.37% per annum with a minimum investment of KSh 5,000. It features high liquidity and no withdrawal penalties, making it suitable for individuals looking for both security and convenience.

| Feature | Details |

| Average Daily Yield | 13.37% per annum |

| Minimum Investment | KSh 5,000 |

Features:

- High liquidity, making it easy to access your funds at any time.

- Investments in high-quality short-term instruments.

- No withdrawal penalties.

- Professional fund management, ensuring capital growth.

Ways to Deposit

- Deposits can be made via M-Pesa paybill number 789012 or bank transfer.

How to Join

- You can join by visiting their nearest branch or signing up through the website.

FAQs

How Do I Choose a Good Money Market Fund?

- Look for high yields, low management fees, and flexible withdrawal terms.

- Consider the fund’s performance history and its asset allocation strategy.

- Make sure that the fund allows easy deposits and withdrawals via methods like M-Pesa.

Is MMF a Good Investment?

Yes, money market funds are an excellent choice for individuals looking for short-term investment options. They offer liquidity, safety, and moderate returns, making them a better alternative compared to traditional savings accounts.

What Are the Advantages of MMF vs. Fixed Savings?

- Higher Returns: MMFs generally provide better returns compared to fixed savings accounts.

- Liquidity: MMFs offer higher liquidity, allowing you to withdraw your money without penalties.

- Diversification: Money market funds invest in a diversified pool of assets, reducing risk.

How Often Does a Money Market Fund Pay Interest?

Most money market funds pay interest daily, with earnings being compounded monthly. This ensures that your money grows over time while maintaining liquidity.

Are There Any Tax Implications for Investing in MMFs?

Yes, interest earned from money market funds is subject to income tax. Consult a financial advisor to understand the tax implications of your earnings.

How Can I Track the Performance of My Money Market Fund?

Most funds provide online portals or mobile apps where you can track your investments, deposit money, and make withdrawals.

Conclusion

Selecting the best money market fund in Kenya involves assessing average returns, management fees, liquidity, and additional features like the convenience of deposits. The funds listed above offer some of the top-performing options in the market, suitable for investors seeking low-risk investment funds. Consider your financial goals and requirements to find the best fit for your money.

Looking to invest in a safe and high-yield option? Explore your choices and select the best money market fund in Kenya today to maximize your returns.